Market

Outlook

Falling with Style

There is more talk of a soft landing for the U.S. economy where recession is avoided. This is possible but we still think a mild recession is likely. Equities can remain supported by soft-landing expectations for the next few months. Government bonds are attractive as most central banks are near the end of their rate hikes.

2025 Global Market Outlook – Annual update

An enduring image from 2024 will be the capture of the SpaceX booster rocket by the mechazilla robot arms on its return to Earth. This amazing achievement symbolizes a year where the improbable became possible, redefining expectations. Similarly, the U.S. economy has remained resilient despite aggressive Federal Reserve policies. Heading into 2025, we expect steady growth and a soft landing for the economy.

Three key macro watch points we think are important for the year ahead:

First, U.S. growth and policy shifts. We expect U.S. growth around 2% in 2025 as inflation cools and the Federal Reserve likely eases interest rates. Growth will be influenced by factors like trade policies, immigration reforms, tax cuts, and the outcome of the 2024 U.S. election. With Republicans gaining more control, tax cuts and deregulation could stimulate growth, while trade tensions or restricted policies may introduce more volatility.

Second, global economic divergence. Europe faces stagnation, Japan shows promise with controlled inflation, and China struggles with a cooling property market and trade restrictions. These regional shifts will impact global markets, requiring close monitoring.

Third, market sentiment and valuations. Equity valuations remain high, but the strong U.S. dollar adds complexity. We think volatility presents opportunities, particularly in sectors like artificial intelligence. Industries such as healthcare and industrials continue to benefit from technological advancements, offering significant growth potential.

So, what do these macro trends mean for portfolios in 2025? With shifting policies, global economic conditions, and evolving markets, we think careful portfolio construction is crucial. Here are three key considerations:

First, balancing U.S. growth amid policy shifts. The U.S. economy is resilient, but the future path depends on evolving policies. Tax cuts and deregulation could benefit small-cap stocks, creating opportunities for growth. However, uncertainty and geopolitical risk will require active management to navigate this volatility.

Second, private markets as a growth engine. Private markets, especially in infrastructure, private credit, and AI-driven startups, offer strong growth potential we think AI now makes up 27% of all venture capital deals signaling significant momentum in the market as interest rates stabilize private markets in Europe Japan and the Gulf States are poised for strong returns particularly in sectors like energy digital utilities and AI sectors.

Third, broadening market leadership. The dominance of mega-cap tech stocks is shifting as smaller, agile companies, particularly in AI, take the lead. This broadening out of market leadership reduces concentration risk and really starts to open up opportunities for alpha generation. Real estate and infrastructure investments are becoming more attractive, providing growth, income stability, and inflation protection.

2025 will be a year of navigating both uncertainty and opportunity. By balancing growth and risk management, we can stay ahead in a rapidly evolving market. We’ll continue to provide deep insights into these macro watch points and their implications for investment portfolios.

Andrew Pease

Chief Investment Strategist

Andrew Pease

GLOBAL HEAD OF INVESTMENT STRATEGY

INTRODUCTION

2023 Global Market Outlook: Q4 update:

Falling with style

Airline pilot Sully Sullenberger achieved a miracle landing on the Hudson in 20091. U.S. Federal Reserve (Fed) Chair Jay Powell’s attempt at a soft landing for the U.S. economy may have an even higher degree of difficulty. This pandemic-generated cycle has been unusual in so many ways that a soft landing cannot be ruled out. But the lessons from previous cycles say that sticking the landing is a challenge. Once the economy starts to slow in response to aggressive tightening, it usually overshoots into recession.

Other developed economies are also under stress from aggressive monetary tightening. Europe appears on the verge of recession and the UK economy continues to stagnate. Japan remains an outlier with accommodative monetary policy and above-trend gross domestic product (GDP) growth. China’s debt and property market problems are intensifying, and the government still seems reluctant to undertake aggressive stimulus measures.

Markets are betting that a soft landing is likely. Industry consensus expectations are for a rebound in corporate earnings next year and interest-rate markets are pricing only modest central bank easing.

We think a mild recession before the end of 2024 is the most likely outcome, but the complexities caused by the pandemic make forecasting difficult. The lockdowns and reopening disrupted supply chains, caused inflation to surge and sent the cycles for goods and services out of sync. Goods demand was brought forward during the pandemic and services consumption rebounded during the reopening. Households emerged from the lockdowns with record cash balances from government support payments and businesses built up large cash buffers during the post-pandemic profits surge.

This is the first significant Fed tightening when neither households or businesses are overstretched in terms of debt or interest payments. For that reason, we shouldn’t be surprised that the lag between Fed rate hikes and the economic impact is taking longer than usual. It is possible that we get a soft landing where the economy cools by enough to allow the Fed to start lowering rates and prevent recession. The economy could also get a temporary second wind if receding inflation boosts consumer purchasing power, or manufacturing has a mini recovery as inventories are rebuilt. This no-landing scenario is the most worrying for investors as it would see the Fed contemplate further tightening and risk an eventual deeper recession.

Our cycle, value, and sentiment (CVS) investment decision-making framework is cautious on the one-year ahead outlook for the S&P 500® Index. Valuation is expensive and the cycle is a headwind based on our view of recession risks. Our proprietary sentiment index has returned to neutral levels after signaling overbought conditions in July. Equities could move higher if markets gain more confidence in the soft landing, particularly now that sentiment is near neutral. The economy may, for a time, appear on track for a soft landing even if it slides into recession later in 2024.

10-year treasury yields near 4.3% offer good value and recession risks provide cycle support. Our annual outlook late last year nominated 2023 as the year of the diversified portfolio, where a traditional balanced portfolio of 60% equities and 40% fixed income does well. This still looks to be the case.

In the 2016 movie, Sully: Miracle on the Hudson, Sully says that “everything is unprecedented until it happens for the first time”. It would be unprecedented to avoid recession after more than 500 basis points of Fed tightening, but not impossible. We think recession is the likely outcome, but Jay Powell will be hoping for a movie called Miracle on Liberty Street2.

This time is longer, not different

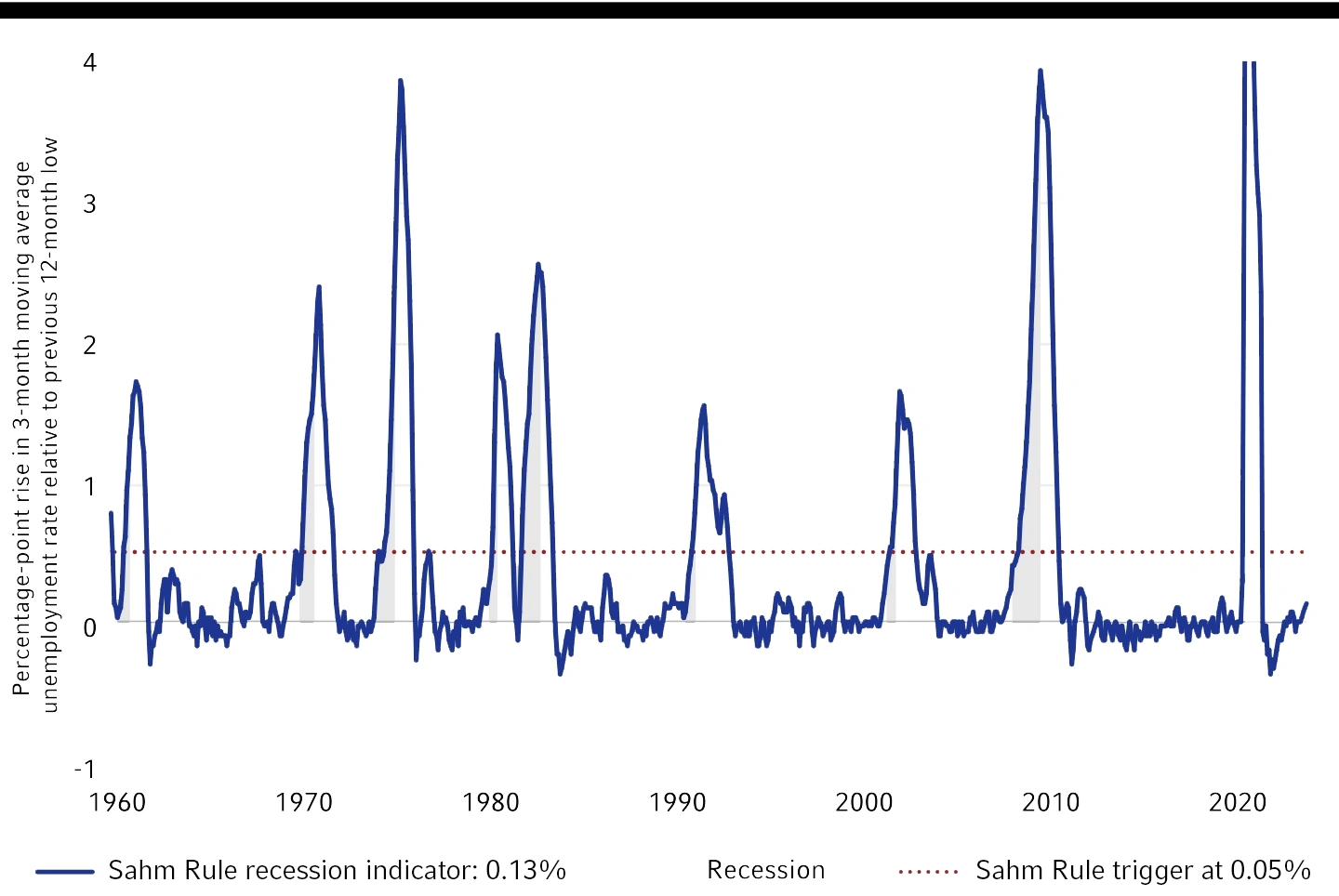

The Sahm Rule3 holds that a recession has started when the three-month moving average of the unemployment rate rises by 0.5 percentage points from its low of the previous 12 months. The rule highlights the self-reinforcing dynamics that take hold once the unemployment rate starts to rise. Rising unemployment signals that firms are belt-tightening. Households become cautious as jobs become more difficult to find. This triggers more austerity and layoffs, which results in further household caution. The process usually starts from the lagged impact of Fed tightening. The Sahm Rule reminds us that it is difficult for the Fed to calibrate monetary policy precisely enough to ensure a policy-induced slowdown won’t slide into recession.

Sahm Rule demonstrates a narrow path for the Fed to avoid recession

Source: LSEG DataStream, as of August 15, 2023. Sahm Rule indicates a recession when the 3-month moving average

of the unemployment rate rises by 0.5 percentage points relative to the low of the previous 12 months.

The U.S. unemployment rate averaged just 3.6% over the three months to August and is the lowest since the late 1960s. By most definitions, this is below the unemployment rate that is consistent with stable inflation. It is likely that unemployment will need to rise above 4% for the inflation rate to decline to the Fed’s 2% target.

A soft landing is possible, but the Sahm Rule demonstrates the narrow path for the Fed to achieve this goal.

China’s difficult choices

The post-reopening optimism on China has quickly turned to pessimism. The problems are focused on the property market and highly indebted local governments. Property development titan Evergrande has filed for bankruptcy and the largest homebuilder, Country Garden, appears on the verge of default. Consumer and business confidence has collapsed, youth unemployment is over 20% and the economy is flirting with deflation. The government has stopped publishing many statistics that show negative trends. The years of double-digit growth are long past, and the International Monetary Fund now thinks that GDP growth will fall below 4% in coming years.

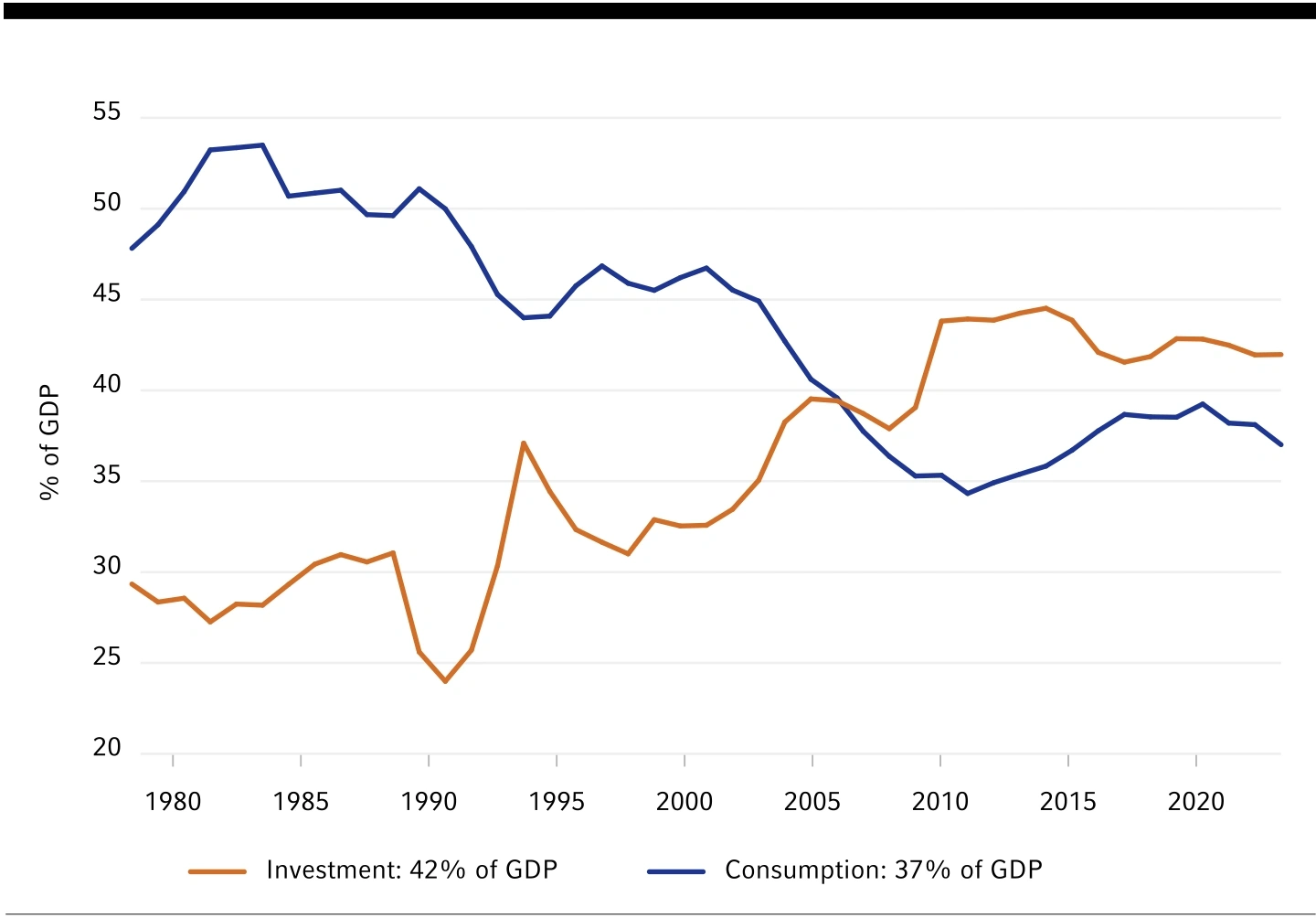

The bears argue that the problems are the consequence of China’s unbalanced growth model. Consumption accounts for just 37% of GDP and investment accounts for 42%. In advanced economies, consumption is more than 60% of GDP and investment is under 20%. A key issue is China’s high savings rate, which at 45% of GDP, is much higher than any other major economy and has led to over-investment. The negative view is that China’s unbalanced, state-directed economy has led to excess debt tied to projects where returns do not cover the cost of borrowing.

China: Investment and consumption

Source: LSEG DataStream, as of June 30, 2022.

However, a 2008-style financial crisis seems unlikely. China’s major banks are government-owned, debt is mostly domestic with very little foreign borrowing, and capital controls makes a capital flight-driven crisis unlikely. A more worrying comparison is with Japan in the wake of the 1980s bubble economy that was followed by decades of sluggish growth and deflationary pressure. The similarities are an aging population, excessive debt, overinvestment in the property sector and reluctance by policy makers to address bad debt problems.

Investors have been waiting for a significant stimulus announcement, but the approach so far has been a series of gradual interest-rate cuts and some easing of mortgage restrictions. A policy response that would lower the risk of a Japan scenario would involve a transfer of non-performing property-related debt from local governments to the central government combined with coordinated fiscal and monetary stimulus to boost consumption, increase inflation, and reduce national savings. China’s president, Xi Jinping, however, seems reluctant to undertake bailouts and major stimulus because of fears of moral hazard, and that higher debt will increase the risk of financial instability. It seems the economy will need to deteriorate further before there is meaningful stimulus.

China, as measured by the MSCI China Index, has been the worst-performing equity market so far this year, and the index is down by more than 20% from its 2022 peak. It is trading on a 10x forward price-earnings ratio, so has good value, and the investor pessimism on China is encouraging from a contrarian sentiment perspective. Confidence in the cycle is the missing element.

The short-term cyclical outlook is uncertain, but there are reasons for expecting that China can outperform some of the more pessimistic medium-term projections. China’s debt levels are not worryingly high in the context of a developing economy that requires large amounts of investment to increase its capital stock and improve productivity. There is potential for catch-up economic growth and China’s urbanization rate is still below that of countries such as South Korea and Japan at similar stages of development. This can help offset the demographic headwinds. There is also China’s advantage in education. It ranked number one for math and science in the most recent Organization for Economic Co-operation and Development (OECD) Program for International Student Assessment (PISA) results in 2018. China has near-term challenges, but we should not be too pessimistic about its longer-term growth prospects.

Canada market perspective

It appears that the positive impact of immigration on the economy may be easing. Gross Domestic Product (GDP) contracted in Q2, likely leading to the Bank of Canada’s (BoC) decision to hold interest rates steady in September. Monthly job growth has been volatile; however, Statistics Canada reported that labor market "churn" is easing, and consumers are becoming more concerned about the economic and employment outlook. Still, inflation and wages remain elevated relative to the BoC's preferred levels, so policy is expected to stay restrictive. But, as signs of an economic slowdown increase, the BoC may no longer feel the need to keep hiking rates.

Downshifting

The Canadian economy appears to be downshifting as restrictive monetary policy is testing its resiliency. Despite better-than-expected job growth in August, Statistics Canada reported that labor market "churn" is declining while “time spent as unemployed” is lengthening. In other words, fewer employees are voluntarily switching jobs, and those out of work are taking longer to find new employment. Moreover, the Canadian economy contracted -0.2% over the second quarter, wildly missing estimates of 1.2% growth. Furthermore, GDP per capita has contracted for three consecutive quarters year-over-year. The worrying growth backdrop likely influenced the BoC’s September monetary policy decision to leave rates unchanged at 5.0%. The central bank also warned the Canadian economy has "entered a period of weaker growth" and that "excess demand is easing." Still, inflation and wages are proving to be stubborn. The average of the BoC's trim and median core inflation rates was 4.0% in August, double the 2% inflation target and the 3% upper range of its 1% to 3% tolerance band. Additionally, wage growth is hovering around 5%, much higher than the 3% to 4% that would be consistent with 2% inflation. Therefore, inflation dynamics have kept the BoC hawkish in tone, stating that it's "prepared to increase" the policy rate if economic data reaccelerated or if inflation remains stuck firmly above its 2% target.

Nevertheless, we are worried about the Canadian consumer, as the fatigue the Canadian economy is experiencing may not be an aberration. In a tracking poll dated September 1, Nanos Research reported that when households were asked what was their "most important national issue of concern," the responses with the largest percentage-point change over the prior month were economy and cost of living. Monetary policy works with a lag, and overindebted households are feeling the crunch as mortgages reset to higher financing rates and squeeze consumer pocketbooks. With debt-service ratios on track to hit new all-time highs, the longer that rates remain elevated, the more susceptible the Canadian economy becomes to a downturn. While an additional rate hike can't be ruled out, household vulnerability to high interest rates may restrict the BoC from tightening policy by much more.

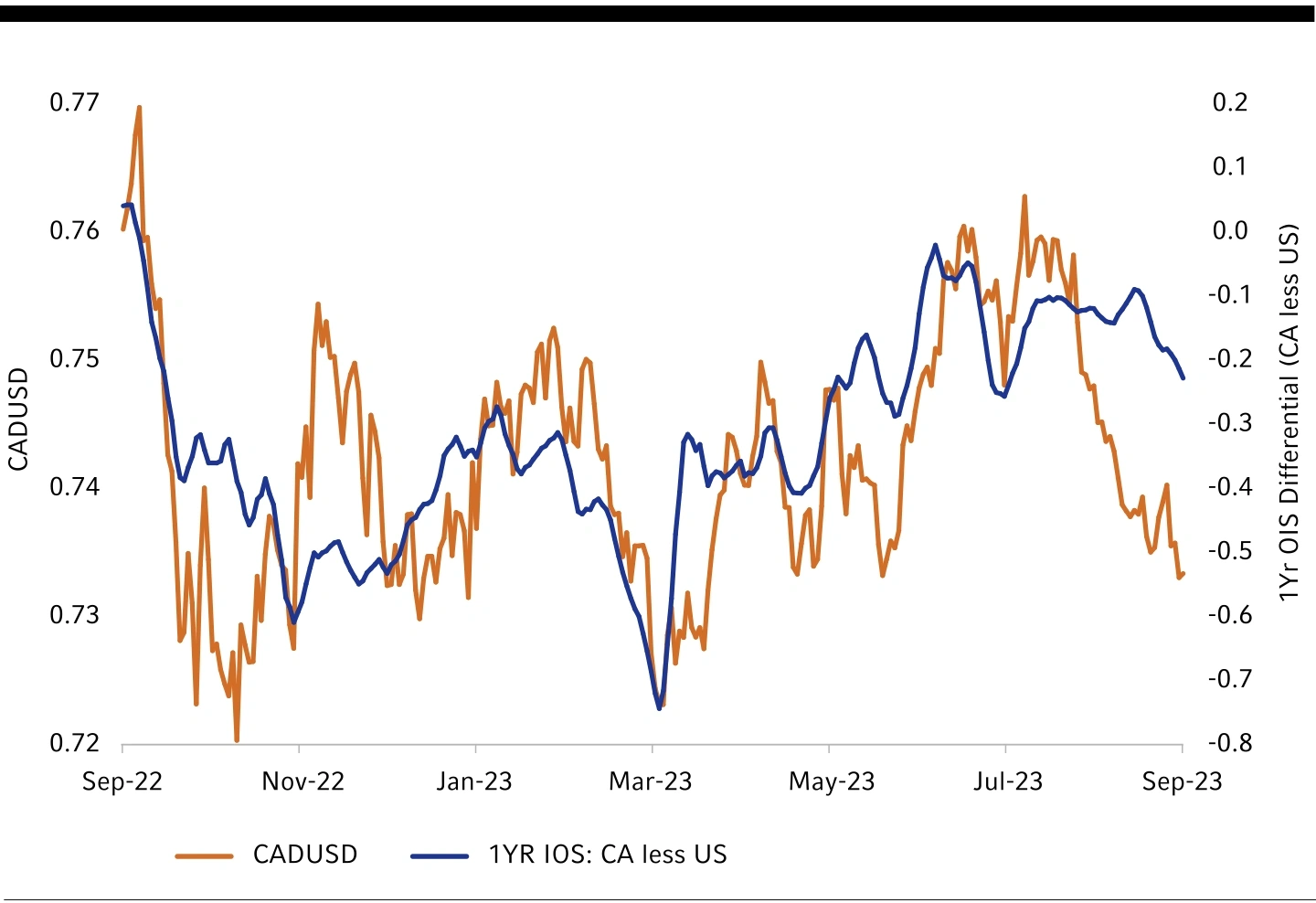

Considering that backdrop, we believe the markets have mispriced the interest rate outlook for the BoC compared to the U.S. Federal Reserve (Fed). If our view that recession risks are higher in Canada than in the U.S. is correct, it isn’t logical for the markets to price roughly 100 basis points (bps) of easing by the Fed through year-end 2024 versus around 30bps for the BoC (as of September 7). With Canada showing more tangible evidence of slowing, the reverse would make more sense. Interestingly, the Canadian dollar (CAD) is likely clueing in on these unlikely market expectations. Chart 1 shows that the CADUSD has weakened by more than what's implied by the one-year forward interest rate differentials, as informed by OIS swap rates. Moreover, crude oil has risen roughly 35% from its March lows to September 13: however, the loonie hasn't benefited as it usually would.

Therefore, while the CADUSD is trading at around a 10% discount relative to its implied Purchasing Power Parity fair value, the business cycle is not conducive for the CADUSD to advance appreciably over the near term.

Chart 1: CADUSD relative to 1Yr OIS differentials

Source: LSEG DataStream, Russell Investments. As of September 6, 2023. 01S refers to Overnight Index Swap and the 1-year 0IS rate

is utilized here as a proxy for interest rate expectations in one year.

Financial markets outlook

Last quarter, we noted the Canadian 10-year bond yield has been rangebound between 2.75% and 3.5% and was likely to stay below its prior high of 3.68%. But the 10-year yield rose to around 3.8% as external factors dominated market sentiment. The high correlation of Canadian yields with the U.S. was evident following the combination of the U.S. Treasury announcing larger auction sizes to finance high deficits and the Fitch downgrade of U.S. treasury debt. The Bank of Japan relaxing its yield-curve-control also contributed to the unexpected move in yields. These three events all coalesced around the end of July/early August. Unsurprisingly, from July 31 to September 8, the U.S. 10-year yield increased by 31bps, more than the 18 bps rise in Canadian yields. Looking ahead, we contend that the Canadian economy is headed towards a recession over the next 12 to 18 months. That means the BoC is, or is very close to being, at the end of its rate-hiking campaign. Indeed, there is the probability of rate cuts rising as the economy slows. While the yield backup hasn't been fun for fixed-income investors, the future total return prospects are encouraging.

A slowing economy means there will be limited upside to yields, and if a recession were to occur, yields should decline as the BoC cuts its target rate to ease financial conditions. A double-digit total return from fixed income is possible in such a scenario. Importantly, fixed income will be crucial in diversifying an asset allocation as the macro outlook becomes more challenging.

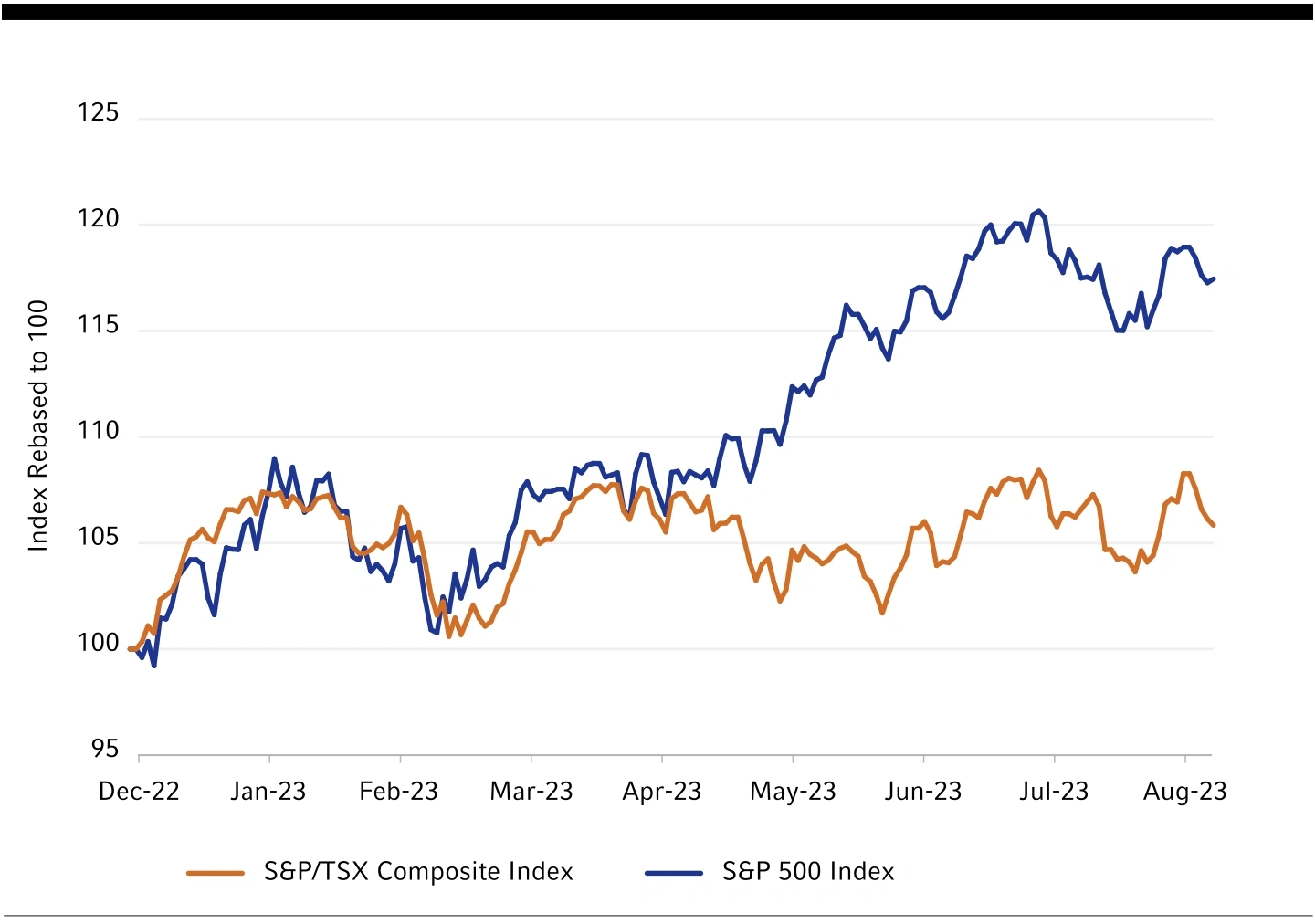

Canadian equities had a hard time keeping pace with the U.S. in the past few months. Chart 2 shows that Canadian and U.S. equities performed similarly from January to mid-May. However, U.S. equities have surged since late May, while Canadian equities have been rangebound. The timing of the performance divergence isn't a coincidence. In late May, Nvidia announced a blowout quarterly earnings as the demand for its computer chips surged, fueled by artificial intelligence (AI) computing demand. Although the underperformance of Canadian equities has occurred chiefly due to AI fueling U.S. tech shares, we are also aware that Canadian shares are more cyclical and could be more vulnerable to a volatile event caused by a recession. Therefore, even though valuations are reasonable, the business cycle outlook keeps us neutral on Canadian equities.

Chart 2: Canadian equities and US equities performance divergence due to AI hype

Source: LSEG DataStream, Russell Investments. Data from December 31, 2022 to September 8, 2023.

Asset-class preferences

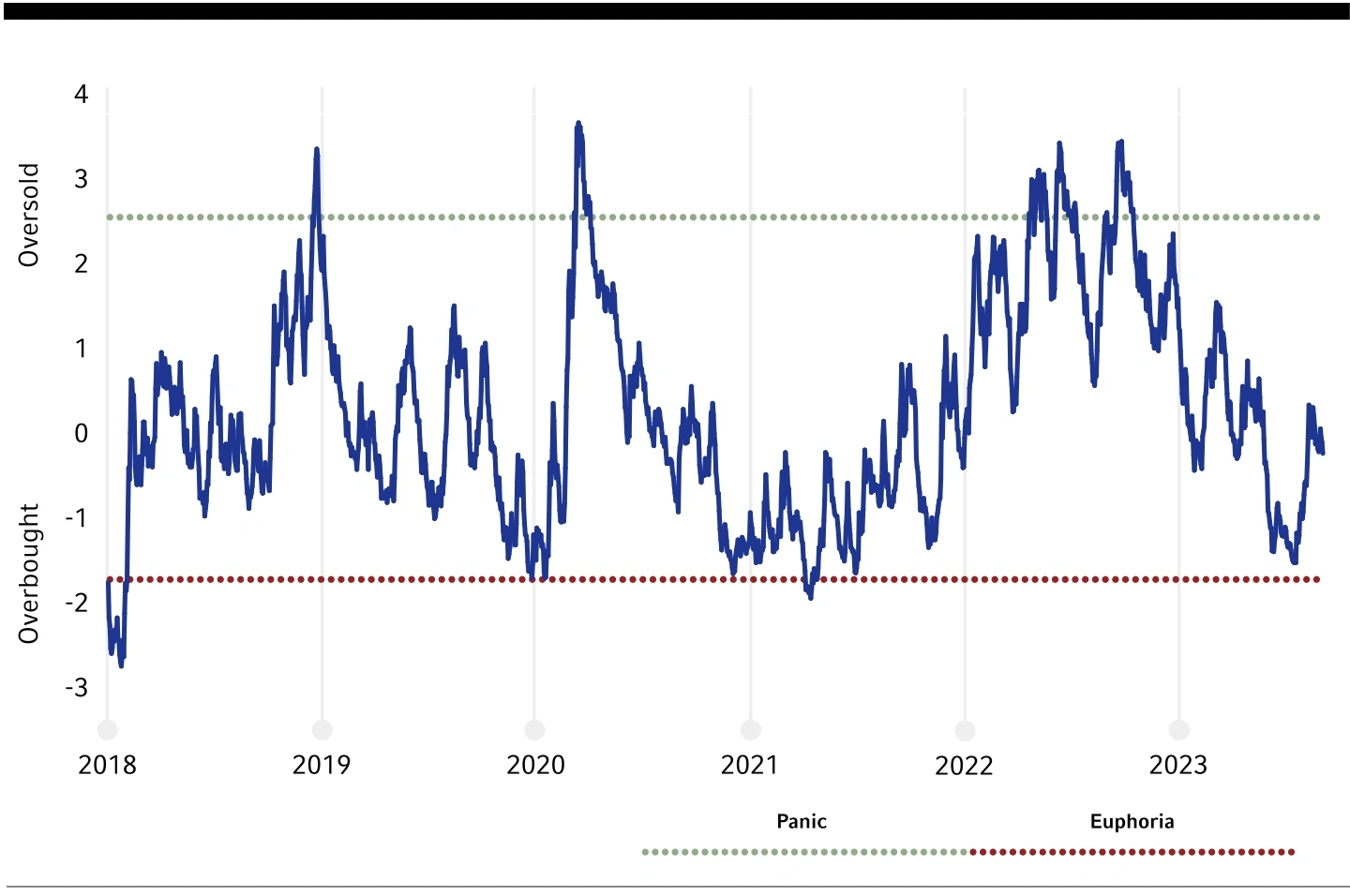

Our cycle, value, and sentiment (CVS) investment decision-making framework is cautious on the one-year ahead outlook for the S&P 500. Valuation is expensive and the cycle is a headwind based on our view of recession risks. Our proprietary sentiment index is now at broadly neutral levels from around one-standard deviation overbought in July. Markets, however, could melt upward5 over the next few months if investors start to believe that a soft landing is likely.

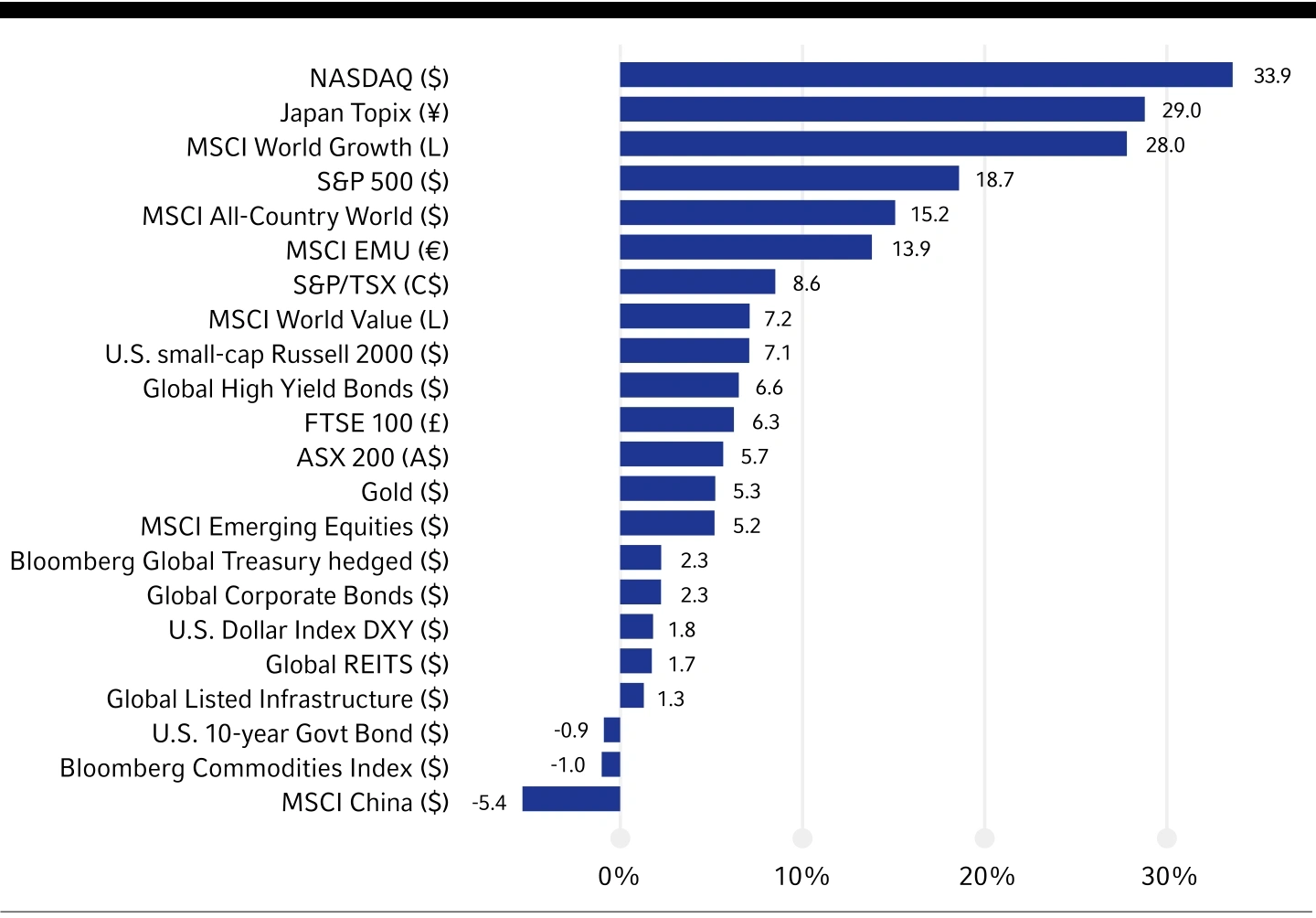

Enthusiasm for stocks linked to artificial intelligence (AI) has cooled over the last couple of months. Even so, the seven largest technology stocks have contributed 13 percentage points of the 17.3% year-to-date return for the S&P 500 (as of Sept. 15). AI enthusiasm is difficult to predict. Investor enthusiasm for AI-related equities could offset cycle headwinds, but it could also create larger downside risk if recession fears prick the AI hype.

Our CVS framework provides a positive outlook for U.S. government bonds. 10-year yields near 4.3% are good value and recession risks provide cycle support. Sentiment is more mixed for bonds but on balance provides some support for a contrarian view. Economic data surprises indices are near peak levels and suggest that data could soon disappoint and support bonds. Commodity Futures Trading Commission (CFTC) data continues to show that speculative investors are positioned for yields to rise further.

Composite contrarian indicator: Investor sentiment moves from overbought in July to broadly neutral

Source: Russell Investments. Last observation is -0.35 Standard Deviations, as of September Il, 2023. The Composite Contrarian Indicator for investor sentiment is measured in standard deviations above or below a neutral level. Positive numeric scores correspond to signs of investor pessimism, while negative numeric scores correspond to signs of investor optimism.

Specifically, we have the following assessments at the beginning of Q4 2023:

- Equities have limited upside with recession risk on the horizon. Although non-U.S. developed equities are cheaper than U.S. equities, we have a neutral preference until the Fed become less hawkish and the U.S. dollar weakens significantly.

- Within equities, we prefer the quality factor, which tracks stocks that have low debt and stable earnings growth. These stocks typically show good relative performance during periods of economic slowdown. Quality stocks are relatively cheap compared to the rest of the market.

- Emerging market equities have underperformed developed markets so far this year. Concerns about China’s economy have been a headwind and these worries seem unlikely to lift over the near-term. For now, a neutral stance is warranted. Emerging markets usually deliver stronger returns when the U.S. dollar is declining. This may be delayed until 2024 when investors start anticipating the Fed will lower interest rates and the dollar declines in response.

- High yield has rallied on soft landing expectations and the spread to Treasuries is below the long-term average. Investment grade credit spreads are closer to their long-term averages. The poor cycle outlook is a challenge with default rates likely to rise as U.S. recession probabilities increase.

- Government bond valuations are attractive. U.S., UK and German bonds offer reasonable value. They have the potential to rally as investors become confident that central banks have finished tightening, inflation has peaked, and economies are slowing. It is likely the U.S. yield curve can steepen in coming months. The spread between the 2-year and 10-year bond yields is close to an extreme. The yield curve tends to steepen after the Fed has completed raising interest rates and markets start looking toward monetary easing. Japan remains the exception, where the 10-yield is around 70 basis points and still expensive.

- Real assets: Real estate investment trusts (REITs) and infrastructure have attractive valuations compared to global equities. While the office sector faces challenges, it is only a small portion of the overall REIT market. The end of Fed rate hikes should favor REITs over equities. Oil has benefited from the OPEC+ supply cuts to push toward US$100 per barrel. The upside appears limited, however given the subdued Chinese economy. This should also weigh on agricultural prices and base metals. Recession risks for developed economies are a further headwind.

- The U.S. dollar (USD) has strengthened over the past couple of months as investors speculate the economy could have a soft landing that would delay rate cuts. The dollar is expensive in real trade-weighted terms and will be under downside pressure if markets lose faith in a soft landing. The Japanese yen is attractive from a cycle and value perspective. At 147 versus the USD, it is significantly undervalued relative to its Purchasing Power parity valuation of 92. Japanese inflation pressures mean the Bank of Japan is likely to eventually move away from yield curve control monetary policy. The euro at 1.07 is also significantly undervalued relative its purchasing power parity value of 1.36. It will appreciate, however, only if markets expect that recession and ECB rate cuts can be avoided.

Asset performance since the beginning of 2023

Source: LSEG DataStream, as of September 14, 2023. EMU refers to the European Economic & Monetary Union.

Regional snapshots

United States

We would be positively surprised if Fed Chair Powell is able to stick the proverbial soft landing: a finely tuned slowdown that stabilizes the U.S. economy at around 1% real GDP growth and 100,000 monthly nonfarm payroll growth. History is not favorable to his chances, and we conclude that a recession is more likely than not in 2024.

Whatever transpires on the recession/no-recession debate next year, the uncertainty around market fundamentals is very high. Market pricing, in contrast, has moved squarely in favor of a soft-landing scenario with equities pricing a rapid recovery in corporate profits; credits pricing little concern over rising delinquencies and defaults; and rates pricing gradual cuts back toward a neutral monetary policy stance. As such our cycle, value, and sentiment process favors a slightly cautious approach to U.S. markets, with selective opportunities in quality equities, front-end Treasuries, curve steepeners4, and agency mortgage-backed securities.

Eurozone

The Eurozone economy is under pressure with Germany, France, Italy, and Spain all flirting with recession. Bank lending and money supply are declining, reflecting the impact of European Central Bank (ECB) monetary tightening. Manufacturing indicators are contracting, and China’s economic downturn is spilling over into Europe through weak export demand.

The ECB lifted the deposit rate to 4% in September and signaled that it may be finished with rate hikes but intends to leave rates at high levels for “a sufficiently long duration”. Markets are challenging the ECB’s higher-for-longer view on the policy rate and pricing nearly 75 basis points of easing over the second half of 2024. We expect markets are likely to be correct given the weakness in key indicators and the downward trend in food and energy prices.

The euro is undervalued and can rise on ECB hawkishness. However, the risk of a policy mistake by the ECB could put downward pressure on the currency over the medium-term. Eurozone equities have performed strongly so far this year but will soon face the cycle challenges of tight monetary policy and recession risk.

United Kingdom

The UK economy continues to track sideways. The economy, which has barely grown since the beginning of 2022, is still around 0.2% smaller than its pre-pandemic peak in 2019. The Bank of England (BoE) has lifted rates to clearly restrictive levels with the base rate at 5.25% and there are signs that the economy is beginning to buckle. Unemployment is rising and job vacancies are falling. House prices are falling for the first time since the 2008 financial crisis.

Core inflation is proving sticky at near 7% but should start to decline once the growth in wages starts to slow. Markets expect the BoE will be on hold until late in 2024, but we suspect that a sluggish economy could see the bank reverse course earlier in the year.

A hawkish BoE should continue to support the British pound. Large-cap UK equities offer good value but could face headwinds due to their relatively large exposure to health, financials and consumer staples, and small exposure to technology firms. UK gilts appear attractive with the 10-year yield at 4.4%.

Japan

The post-lockdown rebound has boosted the Japanese economy, with services spending back to pre-pandemic levels and inbound tourism recovering. These trends are likely to continue. However, industrial production is softening given China’s weakness, and inventories are elevated, which suggests downside risk to production.

We expect the Bank of Japan (BoJ) will further relax its yield-curve control policy over the next six to 12 months, but an increase in the cash rate will require much more evidence that inflation is sustainably at the BoJ’s target.

Japanese equities have been one of the strongest performers this year, boosted by the cyclical tailwind and some initiatives put in place by the Tokyo Stock Exchange for companies trading at less than book value. Both tailwinds may continue. However, Japanese equities are now more than fully priced in, in our view, and will be sensitive to a global slowdown and any yen strengthening.

China

The property market struggles and lack of policy response has led to a further slowdown in the Chinese economy. Consumer confidence and spending is soft, and the labor market is showing early signs of softening. There have been several policy responses, largely aimed at improving demand for housing (particularly in the upper-tier cities) and reducing interest rates. However, we believe that more fiscal spending is required and will be provided if the economy weakens further. This spending will likely be more focused on providing support to the consumer through tax cuts, subsidies, or some form of consumption voucher.

Monetary policy is set to remain accommodative and further rate cuts are possible. Equities in the MSCI China index are trading at depressed valuations with a forward-earnings multiple of 10 times. Our measure of sentiment for Chinese equities shows the market is oversold but has not yet hit the level of panic that would represent a strong contrarian opportunity.

Canada

The Canadian economy is downshifting. Monthly employment has contracted in two of the last four months and labor-market churn has decreased, as employees less actively switch jobs in response to declining vacancy rates. It seems the surge in immigration has reduced labor market tightness.

Aggressive Bank of Canada (BoC) rate hikes have raised debt service costs and forced households to make budgetary compromises. Rising credit card balances and household insolvencies suggest stress is building. Second-quarter GDP contracted -0.2% versus expectations for a 1.2% gain. The results were disappointing even after accounting for idiosyncrasies such as wildfires and port strikes. GDP per capita has now contracted for three consecutive quarters year-over-year.

The BoC communicated in September that a rate hike pause was appropriate, citing that "excess demand is easing" and the labor market is loosening. Even so, core inflation and wage growth are too far above target, and the BoC conveyed that it is prepared to hike further if conditions warrant. Although an additional hike cannot be ruled out, the BoC is near the end of its rate-hiking campaign as the economy continues to downshift. Nevertheless, the policy rate is expected to stay restrictive until the BoC is convinced that inflation is headed substantially toward its 2% target.

Australia/New Zealand

The Australian economy is slowing, but we think recession risk is lower than for the northern hemisphere. The Reserve Bank of Australia (RBA) policy is not as restrictive as central banks in other regions, and the RBA has probably finished tightening. Approximately 70% of households are now exposed to the increase in the cash rate as many fixed-rate mortgages have expired in the last three months. Immigration-fueled population growth will continue to provide a healthy buffer for the economy, with close to 2% population growth expected over the next 12 months. We expect the Australian dollar has some upside, given it is slightly cheap and will benefit from a compression in interest-rate differentials against the United States. Australian equities trade at a discount to global equities and should benefit if there is more meaningful stimulus from China.

It is hard to be optimistic about New Zealand’s economy given the very restrictive stance of the Reserve Bank of New Zealand. The labor market has started to weaken and the number of applications per job posting has surpassed the pandemic’s peak, indicating that the deterioration is likely to continue. The upcoming general election in October is unlikely to change the economic outlook, with neither party indicating a change in the fiscal stance. New Zealand equities screen as slightly expensive relative to global equities, while New Zealand government bonds look attractive given the cyclical backdrop of heightened recession risk.

Prior issues of the Global Market Outlook

1The Miracle on the Hudson refers to a US Airways flight that lost all engine power after striking a flock of birds shortly after take-off from New York’s LaGuardia Airport in 2009. The pilots glided the plane to ditching in the Hudson River, where all 155 people on board were rescued by nearby boats. A National Transportation Safety Board official described it as "the most successful ditching in aviation history".

2The Federal Reserve Bank of New York Building in New York City is also known as 33 Liberty Street.

3The Sahm Rule is a measure for determining when an economy has entered a recession. It was devised by Claudia Sahm, a former Federal Reserve economist.

4A curve steepener trade is a strategy that uses derivatives to benefit from escalating yield differences that occur as a result of increases in the yield curve between two Treasury bonds of different maturities.

5A melt-up is a sustained and often unexpected improvement in the investment performance of an asset or asset class, driven partly by a stampede of investors who do not want to miss its rise, rather than by fundamental improvements in the economy.